UPDATED TUESDAY MARCH 11, 2008

The YELLOW BRICK ROAD TO ARMAGEDDON

Aubie Baltin CFP. CTA, CFA, Phd. (retired)

Both the Economy and Stock Markets are unfolding, almost as if on cue to the play I have been writing during the last year or so. I am not sure whether to be happy or sad as more and more analysts begin to see the dangers that lie beneath the surface and recognize the far reaching effects of the problems You may recall that I was always kind of hoping that this time I would be completely wrong. While it’s nice to get a little company after standing alone; I am sure we would all rather be wrong than have to bear witness to what’s coming.

Why did Bernanke cut the Fed Funds rate by an unprecedented inter-meeting 75bps, followed two weeks later by another 50bps? The flow of bad news in December to mid-January did not, by itself, justify such radical action. In order to understand these moves, one has to read between the lines and ignore the Pollyannish babbling of our Media, Politicians and Financial pundits and look instead at the rising probability of a "Catastrophic" financial and economic collapse (1930’s type depression). It now looks like the Fed is seriously worried about the risks, the likes of which have not been seen since the 1930’s. After a year in which the FED and the Treasury were underplaying the economic and financial risks – The FED has been pressured into taking a very aggressive, wrong headed, Keynesian(Socialist) approach to risk management. To understand the risks that the financial system is facing, let us examine the "nightmare" scenario that financial officials around the world have suddenly become aware of and which can no longer be swept under the rug. To begin with let us assume that the recession, which we will soon discover, started in the last quarter of 2007, will be much worse than those that occurred in 1990-91 and 2001-02 for several reasons. First, we have the biggest housing bubble/bust in US history with some home prices likely to eventually fall 30% to 50% or more. Second, because of deregulation and the elimination of Glass Steagall and a host of other protections put in place (after the last financial debacle) by the Securities Act of 1933-34, a massive credit bubble/crunch was created that has now gone far beyond just sub-prime mortgages. Third, deregulation has caused reckless financial innovation and securitization, causing the FED to lose complete control of the money supply, leading to the worst credit crunches in American history. Fourth, US household consumption which now accounts for more than 70% of GDP have spent well beyond their means for 15 years, piling up massive amounts of debt. Now that home prices are falling and a severe credit crunch is emerging, the retrenchment of private consumption will be serious, longer lasting and far reaching.

The Ten Steps to Financial Armageddon

1. The worst housing recession in US history and there is no sign that it will bottom out any time soon. US home prices will fall between 30% and 50% from their blow-off peaks which would wipe out between $5 and $10 trillion of equity, making the 1987 and 2001-2002 equity destruction look like chump change. While a 20% home price drop will translate into a sub-prime meltdown of about 2.2 million foreclosures, a 50% fall in home values will result in over 13 to 18 million households ending up with negative equity in their homes. What will that do to consumer spending? It won’t be long before a few large home builders go bankrupt, leading to another free fall in home builders' banks and related stock prices. The perennial Bulls, looking at last years earnings began bottom fishing and rallied these stocks in spite of the worsening housing recession, thus giving us a perfect opportunity to short the Home Builders and Banks.

2. The financial system losses from the sub-prime disaster are now estimated to be as high as $250 to $300 billion. But the financial losses will not be restricted to sub-prime mortgages and their related CMOs and CDOs. They are now spreading to near prime and prime mortgages as the same reckless lending practices, i.e. LIAR loans (no down-payment, no income verification interest rate only, negative amortization, teaser rates), were occurring across the entire spectrum of mortgages. All of which were being pushed by Greenspan and the Government promoting the American Dream. Instead, what they have created will be the Great American Nightmare. 60% of all mortgage origination between 2005-2007 had these suicidal features. What happened to risk underwriting? Goldman Sachs now estimates total mortgage credit losses of about $400 billion, but that is based on home prices falling only 20%. The markets for securitization of mortgages - already dead for sub-prime and practically frozen for other mortgages – further reduces the ability of banks to originate mortgages and as their risk tolerance is ever increasing, so are the minimum down-payments and credit score requirements. The huge losses have forced banks to bring back on to their balance sheet all types of toxic off-balance sheet investments and loans turning them into financial Time Bombs. Because of securitization, the toxic waste has spread from the major banks and brokers to their Investors, Pension Funds, Insurance Companies and Money Market Funds in both the US and abroad; increasing rather than reducing systemic risk as well as globalizing the credit crunch. The rest of the world will not be growing fast enough to pull the US out of recession.

3. The recession will cause a sharp increase in defaults in all other forms of unsecured consumer debt such as credit cards, auto loans, student loans, etc. As the Fed Loan Officers Survey suggests, the credit crunch is spreading from mortgages to consumer credit, and from large banks to smaller banks, it is becoming clear that the losses are much higher than the $10-$15 billion rescue package that regulators are trying to put together. The Monolines are actually borderline insolvent if not out and out bankrupt and none of them deserves a AAA rating regardless of how much recapitalization is provided. Any business that requires an AAA rating just to stay in business is a business that does not warrant an AAA rating. However, any downgrade of the Monolines will lead to another $150 to $250 billion of write-downs since it will also lead to huge losses on their portfolio of Muni Bonds. Just their downgrade will spillover into large losses and potential runs on the Money Market Funds that have relied on those AAA ratings. The Money Market Funds that are backed by banks or that bought liquidity protection from banks against the risk of a fall in the NAV may avoid a run, but such a rescue will exacerbate the capital and liquidity problems of their underwriters. Any Monolines' downgrade would lead to another sharp drop in US equity markets already shaken by the risk of a severe recession and large losses in the financial system but worst of all, to a general loss in overall CONFIDENCE. NOTE: The current Monoline rescue talk and/or plans is providing yet another short selling opportunity.

5. As I have been warning you, the commercial real estate loan market will sooner or later enter into a meltdown similar to that of the sub-prime one. Lending practices in commercial real estate were as reckless as those in residential real estate. The recession led by the housing crisis will lead, with a lag, to a bust in non-residential construction. The CMBX index is already pricing in massive increases in credit spreads for non-residential mortgages/loans.

6. It is highly probable that some large regional or even national banks will go bankrupt in the near future. This, like in the case of Northern Rock, will lead to a depositors' panic and concerns about deposit insurance. The Fed will have to reaffirm the implicit doctrine that some banks as well as Fannie and Freddie are too big to fail as well as the FDIC’s Deposit Guarantees. The bank’s losses on their portfolio of leveraged loans are already large and growing. The ability of financial institutions to syndicate and securitize their leveraged loans - a good chunk of which were issued to finance very risky and reckless LBOs - is now or soon will be frozen as another prop to the stock market goes into the DEEP FREEZE. Hundreds of billions of dollars of leveraged loans are now stuck on the balance sheet of financial institutions at values well below par (currently about 90 cents on the dollar, but soon to be much lower). Add to this the many reckless LBOs (as senseless LBOs with debt to earnings ratio of seven or eight had become the norm during the go-go days of the LBO, Pvt. equity bubble) have now been postponed, restructured or cancelled. The problem worsens by the fact that some large LBOs will end up in bankruptcy as some of those corporations that were taken private will go bankrupt in a recession and given the re-pricing of risk, convenant-lite and PIK toggles may only postpone - not avoid - such bankruptcies and make them uglier when they do eventually occur. The leveraged loan mess has already frozen the LBO market leading not only to growing losses, but the elimination of a very lucrative source of income for financial institutions.

7. Once a severe recession is underway, a wave of corporate defaults will take place. In a typical year, US corporate default rates average about 3.8% (for 1971-2006); in 2006 and 2007 this figure was a puny 0.6%. This was due to the lax lending requirements and ultra low interest rates. In a typical US recession, such default rates surge above 10%. Also, during such distressed periods, the recovery given default (RGD) rates are much lower, adding to the total losses from a default. Default rates were very low in the last two years because of a slosh of liquidity, easy credit conditions and very low spreads (with Junk Bond yields being only 260bps above Treasuries until mid June 2007). But now the re-pricing of risk has been massive and Junk Bond spreads are close to 700bps, while the Junk Bond market is now practically frozen.

While on average the US and European corporations are in better shape in terms of profitability and debt burden than in 2001, there is a great many corporations with very low profitability that have piled up a mass of Junk Bond debt that will soon require refinancing at much higher spreads: Corporate default rates will then surge well above the recession average of 10%. Once both defaults and credit spreads are higher, massive losses will occur among the credit default swaps (CDS) that provided protection against corporate defaults. Losses on CDS’s do not represent only a transfer of wealth from those who sold protection to those who bought it. If some of the counterparties selling protection, i.e. banks, hedge funds and large broker dealers go bankrupt, even greater systemic risk results as those who bought protection face counterparties who cannot pay.

8. Unlike banks, non-bank financial institutions such as GE Credit and GMAC etc. don't have direct or even indirect access to the central bank's lender of last resort facility, as they are not depository institutions. In the event of financial distress, they may go bankrupt not because of insolvency, but for lack of liquidity and their inability to roll over or refinance their short term debt, especially since they cannot be directly rescued by the central banks in the same way banks can.

9. Soon, perhaps after one last wishful thinking, short-covering rally, stock markets around the world will begin pricing in a severe US recession as well as a global economic slowdown. The drop in stock markets around the world will then resume with a vengeance as investors begin to realize that the economic downturn is much worse than they ever imagined. Long equity hedge funds will go belly up as large margin calls are triggered leading to a cascading fall in equity prices as a Bear Market is recognized. While a typical US recession causes the S&P 500 to fall by about 28%, this Recession/Depression will not be typical and I am looking for losses in the 50% plus range.

10. Using Economics 101, $200 billion in losses in the Banking system, given a reserve requirement of 10%, leads to a contraction of credit of $2 trillion. Even the recapitalization of banks by sovereign wealth funds (SWF) - about $80 billion so far - will be unable to stop this credit (money supply) contraction. A contagious and cascading spiral of credit contraction, sharp fall in asset prices and widening credit spreads will then be transmitted to most parts of the financial system. This massive credit crunch will make the economic contraction even more severe and the economic recession will become deeper and more protracted. A global economic recession will follow as the credit crunch spreads around the world. A cascading fall in asset prices will cause panic, fire sales and exacerbate the real economic distress as a number of financial institutions go bankrupt. A 1987 style stock market crash could occur leading to further panic. Monetary and fiscal easing, as I have previously explained, will no longer work and will not be able to prevent a systemic financial meltdown. The lack of trust in counterparties driven by the lack of transparency in financial markets and uncertainty about the size of the losses and exactly who is holding the toxic waste securities, will add to the impotence of monetary policy and lead to massive hoarding of liquidity. In this meltdown scenario, the US and global financial markets will experience their worst crisis since the 1930’s.

HOW SAFE ARE WE?

The great false hope.

Ambac had, at one time, a capitalization of $US 5.7 billion, with which it guaranteed bonds of $US 550 billion! REALLY! A 1% misstep wipes out its entire capital. How safe will we be even after some back room engineered re-capitalized bail-out designed primarily to help maintain the dubious AAA ratings. And we call this insurance?

What about the general and much broader US Insurance System which covers

everything from life insurance to fire and accident all the way to hurricanes, tornados and floods? All the US insurance companies will be reporting their financial status by the end of February, but only as of the end of 2007. Being so big, they hold enormous investments in all forms of US financial paper from stocks to commercial bonds, CDOs, CMOs etc. and US Treasuries. Their losses on these investments are certain to be huge, but their report will not reflect their true status because the realization of the damage took place in 2008. Since they do not have to mark to the market every day, their true losses will be even bigger after the market falls further, later this year. The issue now becomes: How “safe” are they?

WHAT CAN BE DONE?

One thing for sure, obfuscation, misinformation and politicizing every problem, large or small, will only make it worse. A recession is inevitable, a depression is not. If Bernanke and the Government can work together to control the recession but allow the economy and the securities markets to heal themselves, while mitigating the harmful effects of the recession, then we may avoid a depression. But if an all out effort is undertaken to stop the recession from running its course, as Wall St is demanding, then matters will get a lot worse instead of better. Can our politicians, the Fed and other financial officials come together and avoid this nightmare scenario? Probably not, unless they all hand in their Keynesian credentials and suddenly read and adopt Austrian Economics, recognize the real problems and are able to differentiate cause from effect. Nevertheless, the answer to this question will depend on whether the policy responses (monetary, fiscal, regulatory and financial) are coherent, timely and credible.

I would not bet on it! My philosophy always remains the same regardless of the situation: “HOPE FOR THE BEST, EXPECT AND PREPARE FOR THE WORST, YOU WILL NEVER BE DISAPOINTED”.

WHAT TO DO NOW?

SELL, SELL, SELL: We are in a BEAR MARKET for BONDS and STOCKS. Get out of all your bonds and money markets NOW! Short Term Treasuries and CDs are ok. Although the FED may try to continue to cut rates, because of our weak dollar they may not be able to. But regardless if they do or not, long term rates will be increasing as sanity finally returns to the marketplace and risk once again becomes part of the cost of borrowing.

The 64.2 % reading was high enough to set the stage for the substantial Pull-Back rally into the Bernanke trip to Washington.

Sell and go short into any 450 to 750 point (38%) DJII retrenchment rally. You can now buy Puts on the ETF’s that you think are the most vulnerable such as the XLF (Financials) or you can buy the pro ETF’s that go up when their related indexes go down (i.e QID represents double down the QQQ’s) AND/OR you can just accumulate more GOLD and SILVER stocks and Bullion.

NOTE: This is not a handholding Day Trading Letter, so don’t expect specific option or stock trading recommendations. I only name buy and hold LT positions.

GOLD

The Selling Of IMF Gold: Calls Attention To The REAL Problems.

Ever since its beginnings in the late 1940s, IMF Gold sales have always coincided with a last ditch emergency act in response to a global monetary crisis. Only Gold stands as a valid alternative to failing Fiat monetary systems. IS IT CRISIS TIME AGAIN? Every time the IMF has sold “official” Gold, it soared. In the late 1970s, as US consumer prices were soaring, both the IMF and US Treasury were selling Gold out of their respective inventories. The response to that was Gold gapped up $20 to $40 at every auction. So instead of with dread or fear, I welcome IMF Gold sales.

RIDING THE GOLDEN BULL

The early 1970’s saw Gold go from $35/oz to $200/oz., a 570% increase in less than three years which, at the time, marked the end of Wave I only. A similar move today since we are now in the final stages of Wave I , just like we were back in 1975, would give us a target of ($250 X 5.7) $1425 and that would only complete a 7 year Wave I of an ongoing 5 wave, 16 to 20 year Bull Market for Gold. Do I have to spell it out for you what you should be investing in?

SENIORS vs JUNIORS

Both the Juniors and to a lesser extent the Seniors and Mid Caps have been lagging the rise in the Gold price, instead of leading it as they usually do. Let us now all complain and keep looking a gift horse in the mouth instead of slowly and quietly doing our homework and accumulating the once in a lifetime bargains that are staring us all in the face.

Usually it is “hurry up and buy before the bargains run away”. My crystal ball is a little cloudy, but I am convinced that in the not to distant future, they will catch up and surpass Gold and Silver Bullion. I am running out of time and space, so if you want to know why this abnormal occurrence is happening, you will have to wait for my next letter or go to Gold-Eagle.com where you will find a good number of knowledgeable Gold and Silver people. In the meantime, my TUNE has not changed for the last SIX years: BUY - DO NOT TRADE. Buy more on dips and retrenchments and hang on for dear life as the GOLDEN BULL will definitely try its best to buck you off.

NEW POSITIONS

Bought Miranda Gold (MRDDF) at $0.58 and looking to Buy March in the money Puts today on C, JPM, LEN and LOW

GOOD LUCK AND GOD BLESS

February 27, 2008,

MY SUBSCRIPTION LETTER, “UNCOMMON COMMON SENSE” was started Feb. 1st. We are now living in the type of times in which you will definitely want to be kept abreast as to what is really happening on a regular bi-weekly basis. A 3 month trial subscription is only $55. One Year $199: Call for more info.

Aubie Baltin CFA, CTA, CFP, PhD.

2078 Bonisle Circle

Palm Beach Gardens FL. 33418

aubiebat@yahoo.com

561-840-9767

Please Note: This article is for education purposes only and is designed to help clarify your thinking, not lead it. Only you can decide the best places to invest your money and the degree of risk that you are prepared to take. The Information or data included here has been gleaned from sources deemed to be reliable, but is not guaranteed by me and may have already been overtaken by events. Nothing is stated here should be taken as a recommendation to buy or sell securities. Consult with your own financial advisor before making any investment decisions.

.38 Special LSWCHP +P: Still a Top Load?

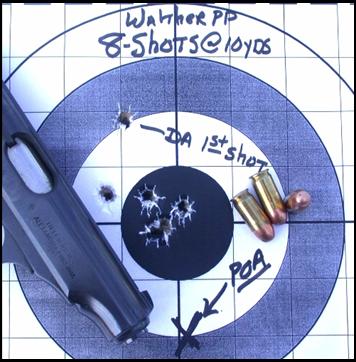

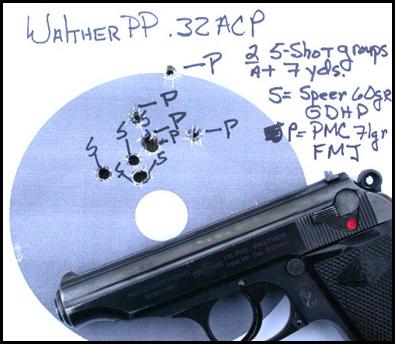

By Stephen Camp

www.hipowersandhandguns.com

Despite improvements in popular defense calibers like 9mm and .45 ACP as well as some new ones such as .40 S&W, .357 SIG, and .45 GAP, the .38 Special continues to sell as a self-protection round. With the police move to autos in the '80's, the "shakers and movers" in this caliber are now the snub revolvers. This is probably due to the concealed handgun licensing laws allowing private citizens to legally carry. In police circles, the .38 Special fills but a few duty holsters these days, just the opposite of a few decades ago. It still serves in the role of back up for more than a few lawmen.

Just as was the case 30 years ago, the .38 Special just didn't "shine" as a top "stopper" in any barrel length. The traditional 158-gr. LRN bullet loped along at some 800 ft/sec from the usual 4" barrel and the picture grew bleaker when using short-barreled revolvers.

Super Vel sought to change this with a hot 110-gr. JHP and eventually other ammunition manufacturers began doing the same. Commercial ammo used bullets from 90 to 158 grains with the most popular seeming to be in the 110 to 125-gr. weight range. It seems that some improvement in "stopping power" was observed over the old 158-gr. solids as well as the pitifully slow 200-gr. "Super Police" round nose load that was becoming almost nonexistent.

A popular defense load for the .38 Special appeared during this same time frame. It has been referred to as "The FBI Load" or "The Chicago Load" and I've seen it called "The Dallas Load" a few times. Whatever it was called, the round consisted of a lead SWC with a deep hollow cavity loaded to +P pressure.

It seemed to hit closer to point of aim in the fixed sight revolvers common at that time and field reports indicated that it was fairly effective. It is a safe statement that this load became quite popular whether offered from Remington, Federal, or Winchester. I do not recall which came out with it first.

Today, it still remains the top choice for some people, but is being challenged by some "new technology" bullets said to work more reliably over more varied conditions. Corbon has a light-for-caliber X-bullet, which penetrates more deeply than might be expected, and Speer is offering a mid-weight 135-gr. Gold Dot designed especially for use in shorter barrel lengths. Both are also loaded to SAAMI +P pressure levels and a myriad of 110 and 125-gr. JHP's are available as well.

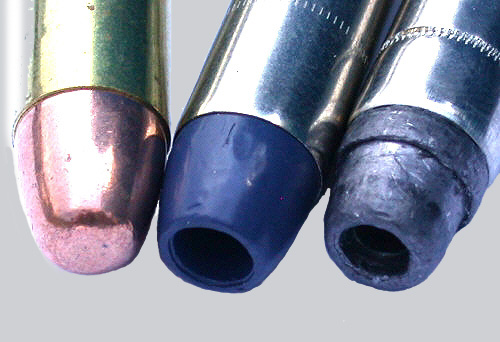

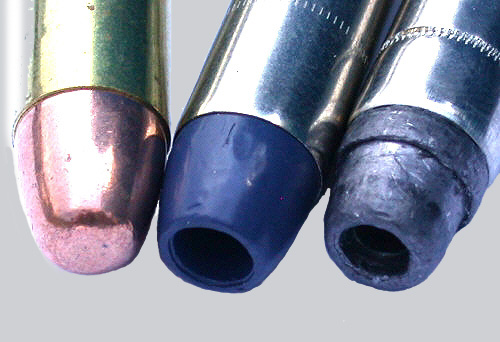

Here are three cartridges for the .38 Special. From left to right: 130-gr. FMJFP, standard velocity 125-gr. Federal Nyclad hollow point, and a Remington 158-gr. LSWCHP +P. The FMJ is almost always used for practice while the other two were designed to expand in soft targets. The Nyclad was originally a SWC design intended for indoor target work. They were offered in both standard and +P loads, but neither is available from Federal today for use by private citizens. Both these hollow points would be considered "old technology."

Though most attempted to up the .38 snub's "stopping power" with higher velocities and better bullet design, one school suggests using the old 148-gr. full wadcutter, citing that many expanding designs simply don't after passing through 4-layers of denim before striking 10% ballistic gelatin. They cite sufficient penetration and low recoil being characteristic of this load. After all, if the expanding bullets don't after passing through the denim, why not go with the lighter, easier to shoot wadcutter?

Here we see the LSWCHP next to one of the latest entries, the homogeneous copper alloy Corbon DPX. At the bottom is the aggressive expanding JHP loaded to +P+ pressures. All are above standard pressure levels and approach enhancing "stopping power" differently. The "old technology" LSWCHP might be thought of as a homogeneous bullet like the DPX. It has no copper or jacket while the DPX has no lead. The LSWCHP is in the traditional weight and moves between 800 and about 900 ft/sec depending upon barrel length. The DPX is lighter and averages just under 1100 ft/sec from my snubs. The hot Corbon 115-gr. +P+ is no longer sold. This one exceeds 1180 ft/sec from a 1 7/8" barrel! Frankly, I'm hesitant to shoot it in my personal revolvers for fear of possibly cracking the thin forcing cone walls.

Thus, we see different approaches to a common problem and different criteria by which to judge effectiveness. Though kinetic energy figures were very commonly used to describe stopping power in the past, it is considered almost sacrilege to do so today. Some continue to go for higher than normal velocities with superbly designed expanding bullets while others go with a lighter recoiling flat solid, but the LSWCHP +P continues to sell and remains a very popular choice.

Why is this so?

-

My own reasons for sticking with this "old technology" load are several.

- It has had time to develop a "history." It has been used against human opponents enough to actually see that it "works" more than it "fails."

- Because it is in the traditional bullet weight, POI is usually quite close to POA in fixed sight revolvers.

-

In the lightweight revolvers, recoil is present to be sure, but it doesn't seem as sharp as with the fast, light-for-caliber bullets. (An example would be Corbon's 110-gr. JHP +P, not DPX.)

- This load can be found at more places than many of the newest loads, but it too can sometimes be elusive.

- It performs well in 3 and 4" barrels and allows for a single, reasonably effective load in all my 38-caliber revolvers.

Where the 158-gr. LSWCHP seems to fall from favor is when it is fired from 2" revolvers through 4-layers of denim before impacting 10% ballistic gelatin. This protocol is described by its supporters as a "worst case scenario" and not necessarily realistic. They opine that if a bullet will expand after punching the denim, it will usually do so for real and under most circumstances. (Note: This doesn't seem to be a problem when the LSWCHP is fired from 3" or longer barrels.) For this reason, the group supporting the denim test usually suggests using the 148-gr. wadcutter in the snub .38 revolver. They cite that it gets plenty of penetration, has low recoil, and does as good as an expanding bullet that doesn't expand.

Some of this makes sense to me. The wadcutter does kick less. It does penetrate sufficiently, at least in gelatin, but having chronographed some from an S&W snub at a "blazing" 541 ft/sec, I somehow don't think that this is quite as wise a choice as some might imply. Before I retired as a police officer, I spoke with a young man who'd been shot but a moment before with a .38 Special snub. He was sitting on the curb and looked like he wasn't feeling very good, but he could easily have pulled a trigger had he a gun and the inclination. It turns out that he died four minutes later in the ambulance I called.

He'd been shot through the heart with a .38 Special 148-gr. wadcutter.

I spoke with two officers from other agencies that had been forced to use their snubs against felons. Each was using the 158-gr. LSWCHP +P, but I don't remember which brand. Each decked an opponent with a single shot each to the chest. If memory serves, one of the crooks died, but both stopped and dropped when shot. I'm sure that there have been failures as well, but often wonder how much of this might be due to less than good shot placement because the little snubs can be difficult to shoot accurately if one is not practiced with them.

These bullets were fired into water from 2" .38 Special revolvers. The bullet at the left is from Remington and is softer than the deformed, flattened one on the right, which is from Winchester. (I am not sure where the Federal version falls in lead composition.) To me, the Remington is the better choice if a snub is being used. The Winchester sort of morphed into a wadcutter, but is traveling significantly faster so I'd pick either before I'd go with a target wadcutter as is sometimes suggested. When fired through the dreaded 4-layers of denim, the Remington acts about like the Winchester when the latter is fired directly into water. To me this still beats the wadcutter.

Again we see the expanded Remington (left) and Winchester 158-gr. LSWCHP +P's after being fired into water. This time there is less dramatic differences in expansion. That's because they were fired from 4" barrels. If my revolvers had barrels no shorter than 3", it wouldn't make me a lick of difference which was used. I'd probably go with whichever grouped best or cost less. In the snub, I definitely prefer Remington.

Though I've not tested them yet, the Speer 135-gr. Gold Dot "Short Barrel Load" appears to be very promising. It has a soft jacket with more copper content than traditional gilding metal and the bullet is reportedly designed to expand well at .38 snub velocities and to do so after passing through 4-layers of denim. (The DPX is said to do this as well.)

From a 2" vented test barrel, Speer reports that the 135-gr. Gold Dot +P averages 860 ft/sec. From my "slowest" barrel Model 642, Remington's 158-gr. LSWCHP +P hits 800 ft/sec with monotonous regularity.

With the Speer we have 7.5% more velocity, but trade 14.6% bullet weight to get it. Until I get a chance to really look at how this stuff performs, I believe I'll just stick with the old style LSWCHP.

From left to right we have an unfired 45-caliber 200-gr. SWC, an expanded Remington 158-gr. LSWCHP +P, and an unfired 38-caliber 158-gr. SWC. At reasonably similar velocities which appears to be capable of leaving the largest diameter permanent cavity? The LSWCHP normally penetrates between 14 and 16" of 10% ballistic gelatin. The one I saw recovered from a previously wounded deer expanded in a fashion similar to the one in the picture, but was more uneven. It was fired from a 1 7/8" S&W Model 60.

Can we make the .38 Special a more potent load? Yes, I think we can, assuming that bullet placement remains in the equation, but I just don't think that it will ever be the "stopper" that some other calibers are. I try and pick what I believe to be a "good" load and then concentrate on practice. The 158-gr. LSWCHP +P from a snub S&W revolver is about as low on the ballistic totem pole as I care to go.

Here we see the Remington 158-gr. LSWCHP +P (center) compared to some other popular defense loads in other calibers. All were fired into water. Top Left: 9mm 127-gr. Winchester Ranger fired from a Browning Hi Power. Top Right: .45 ACP 230-gr. Ranger fired from 5" Kimber. Bottom Left: Hornady 90-gr. XTP fired from a Bersa. Bottom Right: Corbon .357 Magnum 125-gr. DPX fired from 2 1/2" S&W Model 19. I suspect that the 9mm, .357, and .45 loads are more likely to incapacitate quicker than the .38 LSWCHP +P, but still submit that this load is worthy of consideration in a snub. Its effectiveness is no doubt better in a 3 or 4" barrel revolver.

Some report problems with leading, but I've not seen this in any S&W, Colt, or Ruger revolver that I've fired this ammunition through. I have seldom fired more than 50 shots at a time, however, and I reckon it is possible if firing more than that between cleanings or in a rough bore.

Until I get the chance to personally try more of the latest loads for the .38 Special and see how they are performing in the real world, I'll just stay with this old load.

For those interested, here are some average 10-shot velocities for this Remington round:

S&W Model 642 with 1 7/8" bbl: 800 ft/sec

S&W Model 19 with 2 1/2" bbl: 860 ft/sec

S&W Model 64 with 3" bbl: 883 ft/sec

Ruger GP100 with 3" bbl: 894 ft/sec

Ruger SP101 with 3 1/16" bbl: 906 ft/sec

S&W Model 10 with 4" bbl: 888 ft/sec

I cannot say if the newer attempts to increase the .38 revolver's "stopping power" are better, worse, or about the same as the old lead hollow point; they just have not had time to produce a track record. In the meantime, I'll stay with the LSWCHP +P in my .38 Special revolvers…but I'll be looking at the new stuff, too!

************************************************************************************

www.actionsbyt.com

www.actionsbyt.blogspot.com

www.tacticalknives.blogspot.com www.actionsbyt.typepad.com

www.actionsbyt.wordpress.com

www.truthaboutparts.blogspot.com

www.commentsbyt.blogspot.com

www.tjofsugarland.blogspot.com

www.handgunpartsforsale.blogspot.com

www.hipowersandhandguns.comwww.mouseguns.com

www.trippresearch.com

www.wowtexas.com

http://www.spw-duf.info/links.html#guns

***************************************************************

| Like many issues, the choice to have guns among your survival gear is up to the individual. Both Stan and I grew up in families that had firearms. My dad was a Marksman in the Army and Stan was captain of his school small-bore rifle team and also beat the NRA National Champion in an unofficial match while attending the US Air Force Academy. If gun laws were such in Australia, we would include them in our survival gear. As it is, they are permissible only under certain circumstances.

Many folks have written saying the weapons issue should be addressed whether for personal protection or hunting game. As a self-professed gun illiterate, a knowledgeable friend in law enforcement, wrote this concise and informative primer on useful firearms.

Different people's experience can produce different findings and weapons is no different. Shortly after the Firearms page was uploaded, another law enforcement officer, Erik, offered his analysis based on his experience. Erik is a professional law enforcement officer and firearms instructor full-time. He's also a 10-year veteran of active and reserve military. If you would like to contact him, Erik's email is mrlne95@hotmail.com

Our third contributor is also a law enforcement officer in Western Australia with a total of 18 years to his credit. Six of the 18 years were spent with Special Forces in the Australian government. He has also studied various martial arts including Judo, Ju-Jitsu, Ti-Chi and Karate for over 30 years. Below you'll find valuable information regarding personal protection applicable for most countries.

Overall the three men have similar takes on guns, but it's always valuable to discuss some of the finer points. The original text is in blue, Erik's contribution is in green and our Australian law enforcement officer's expertise is in purple:

Primer on Personal Security

Firearms are merely a means to an end. First and foremost, it must be remembered that a firearm in the hands of an inexperienced person will do as much damage to them or their family as it will to the object that they wish to shoot.

There are countless examples of children being seriously injured or killed because the weapons were not secured or the various parts, i.e. stock, bolt and ammunition etc. were not stored separately.

There are also many stories of persons having had their firearm taken from them and the offender turning the weapon on the owner.

What I am alluding to is that there is no substitute for proper training . Remember, shooting is a skill which needs to be kept current as does your first aid skills. If you are going to have firearms, learn how to deal with firearm-related injuries.

In relation to the type of firearm required, it is important to decide what the firearm is intended for, i.e. the procurement of food or for personal protection. There are three basic types of firearms to be consider and each has a particular killing zone. The killing zones are as follows:

1. Personal killing zone - distance to target 0 to 10 meters (0 to 33 feet)

2. Middle killing zone - distance to target 10 to 100 meters (33 to 328 feet)

3. Long range killing zone - distance to target 100 to 1000 meters (328 to 3280 feet)

A further point to consider is where am I going to carry the firearm.

Special Forces training indelibly imprints on the mind of its members the three areas that items are kept. They are :

1. On the person: These items are on you at all times, and include: - Personal Survival

- Medical

- Protection Items (A K-Bar knife is recommended which is a Marine solid core, straight blade, survival knife.)

2. On webbing: These items are within arms reach all the time, and include: - Emergency Water

- Shelter

- Warmth

- Food Items

- Personal Protection Items

(An Emergi-Pak from TECFEN Corporation is recommended along with 1 litre of water, a hand gun and ammunition.)

3. In pack: These packs should be stored "ready to go" in an area that can be accessed very quickly, i.e. keep one in the house, one in your vehicle etc. and include: - 5 litres of Water

- Small Tent

- Change of Clothing and Footwear

- Food for 5 days

- Personal Medical Supplies

- Fold Down Survival Weapon

One weapon will not satisfy all of your requirements so consider your choice carefully.

For a hand gun, Special Forces carry a revolver. Revolvers require less maintenance than pistols. Pistols have many moving parts and if you are unfamiliar with the weapon they are prone to jam. The United States Air Force has what I consider to be one of the ultimate survival hand guns. The revolver has 3 barrels and 3 cylinders enabling a rapid change from a 22 caliber, to a 38 special to a 44 magnum.

The 22 caliber is used for hunting small game; hollow point rounds are recommended. Sub-sonic rounds can be purchased to lessen the sound if noise is a consideration. "Stinger" ammunition (also 22 caliber) is recommended for larger game up to the size of a medium sized dog. It has a higher velocity than the standard 22 round and with a pentagonal hole in the projectile rather than a "Hollow Point". The projectile fractures evenly on 5 points resulting in increased trauma to the game.

The 38 special can be used for larger game as well as being a formidable caliber for personal protection. Finally, the 44 magnum is capable of inflicting huge traumas to everything it hits.

My recommendation for personal security in the home would be a 12 gauge or 20 gauge shotgun with an 18 or 20 inch barrel. The 20 gauge has a lot less kick and performs almost as well as the 12 gauge. 00 buck (buckshot) ammo is the equivalent of firing a dozen rounds from a 9mm handgun all at once, and is the most deadly gun made. The short barrel is good for large game under 100 yards with slug ammo, and with a longer barrel and different ammo you can hunt any kind of bird, rabbits, etc. Barrels are interchangeable. A Remington 12 gauge with a 28 inch barrel can be had in the US for about $210 new. A .410 shotgun is good for rabbits, but not for protection unless you can hit someone in the eyes with it.

Most of this is true, except for two points:

1. The recoil of a shotgun is so severe as to be difficult for most women, small men, or younger children. For these people, I would recommend a pistol-caliber carbine, such as the US M1, Marlin Camp, or Ruger. These guns are available (US) in the same price ranges as a shotgun.

2. The lethality of the shotgun is often overestimated. In many shotgun patterns, close to 50% of the pellets may miss or hit non-vital areas, even at close range. Follow-up shots are difficult because of the recoil. Accuracy is a MUST, so you have to practice with this or any other firearm.

For protection, a good semi-auto rifle in 7.62x39 or .223 (5.56mm) is, in my opinion, the best choice. It has low recoil, high capacity, and is very accurate, even out to up to 400 meters. It can also be used for hunting small game, or, in the case of the heavier 7.62 round, even deer. Examples include the Ruger Mini-14, Colt AR-15, AK47 or MAK-90, SKS, or M1 Garand.

Lever-action rifles in .30-30 are also a good alternative to a semi-auto. Winchester Model 94 or Marlin 336 or 30AW.

For a personal protection handgun, the most deadly is the .357 magnum revolver with a 125 grain hollow point bullet. It far surpasses Clint Eastwood's movie .44 magnum for one shot kills. However, the .44 magnum with a 6 inch barrel or longer, is the best hunting handgun available without going to some of the more exotic calibers. A revolver is simple to use and trouble free. I recommend a Smith and Wesson .357 for ease of use and cleaning, or a Ruger .357 for durability if you are going to drag it through the desert, swamp, jungle, drop it from an airplane, etc. Tarus makes a very good and inexpensive gun too.

I concur with this, except remember again the .357 recoil is tough to get used to.

For a semi-automatic handgun, where I work, new Deputies are required to carry a Glock .40 caliber. It is the most efficient and deadly available and an excellent gun. It's one of the new "plastic guns".

I don't have a quarrel with the Glock in a survival situation, but the .40 is not a good idea. 9mm is just as effective when shot accurately and is much easier to obtain in large quantities.

Everyone should have a .22 rifle. It is good for target practice and is more deadly than some of the larger caliber guns due to the high velocity of the bullet causing deep penetration. I know people who illegally shot an elk and a trophy deer at close range with a .22. I get a lot of disagreement from people, but if I had to choose one all-around gun to have it would be the .22.

I agree wholeheartedly with this.

For hunting, a .270 rifle or larger with a scope for big game is best. Smaller calibers are used, but most hunting articles I have read say the 30-06 is the best hunting rifle for North American big game. I use a 30-06 but prefer my sons .270 since it has so much less kick. Shoot what you are comfortable with. For smaller game such as varmints, a 22-250 is very good.

Your semi-auto 7.62x39 I mentioned earlier should be adequate for deer. .30-06 and .270 are excellent calibers, but I would suggest .308 (7.62x51mm) because, again, it is easy to obtain in large quantities.

Again with rifles, there are many to choose from the 177 air rifle to the 50 caliber. With a 50 caliber Browning sniper rifle with telescopic mounts, a kill shoot in excess of 3000 meters (10,000 feet) is possible. The longest confirmed kill by a 7.62 x 59mm round was 2,800 meters.

My personal choice in rifles would consist of 2 weapons. The first would be what is known as an over and under. What this means is that a 22 caliber rifle sits on top of a 12 gauge shot gun. Remember in survival, everything needs to have more than one use.

My second rifle would be in 5.56 mm (223) caliber. This is a standard military round preferred by the United States and Australian Defence Forces. The temptation is to go for a weapon like the AR15, M16 or Styeir rifle. All of these rifles are military weapons capable of single shot, semi-automatic or fully automatic fire. Once the testosterone levels have subsided, a bolt action rifle should be your choice. Handled correctly a bolt action is almost as fast as a semi-auto and there are less things to go wrong. Remember, the simpler it is, the better in a survival situation.

Remember, to stockpile ammo, you need a lot of it. I recommend military calibers, because the surplus market allows you to buy in quantity.

Revolver: .38 Special Auto-Pistol: 9mm NATO (aka 9mm Parabellum) Rifle: 5.56mm, 7.62x39mm (Soviet), 7.62x51mm (NATO)

It would seem inappropriate to use a 7.62 x 59mm (standard NATO round) to hunt rabbit, but it may be very appropriate to hunt predators such as bear or man.

Eventually we would run out of ammo, so reloading becomes a necessity. Reloading is expensive to get started in, but once the initial investment is made the ammo is cheap to make.

A good sources of reloading supplies is:

Midway

5875-D W. Van Horn Tavern Rd.

Columbia, MO65203-9979

1-800-243-3220

FAX 573-446-1018

I have read both Erik and the other officer's comments and I agree with a lot of what they have said, but in the end it comes down to personal choice and reasons for purchase.

Stay with weapons that have a common caliber, have minimal moving parts and learn the associated skills that go with hunting. Those associated skills are tracking by sight and sent, snares construction, animal butchering, camouflage and concealment. In addition to these skills, you will need to know the animals habits and movements. Also, learn what defenses the animal possesses; nothing should come as a surprise in a survival situation - surprises kill.

If you intend to use modern methods to hunt at night such as Night Vision Goggles, infrared red or thermal imaging, sound or movement detectors, learn there capabilities and limitations.

For purchasing and licensing of firearms, it is recommended that you attend your local Police station to obtain your state's current legislative requirements. Some states require you to belong to a gun club before purchasing firearms. This is a common sense approach as it allows you to try several types, makes and models of firearms before purchasing your own. It also means that you are trained correctly in the use, care and safety of you firearm.

A final note, remember experience is the only true teacher.

Equipment, Supplies, How-to Books

Wideners Reloading & Shooting Supplies

http://www.wideners.com

P.O. BOX 3009 CRS

Johnson City, TN 37602

Phone: 423-282-6786

Fax: 423-282-6651

Order Line Only: 800-615-3006

Reloading supplies are normally easy to come by. HOWEVER, when HCI (Handgun Control Inc.) and President Clinton attempted their gun grab several years ago, it was almost impossible to get primer caps (ignites the powder) at any price due to so many gun owners stocking up in case they were successful in their hair-brained scheme. Things are back to normal now, but shortages will occur again with the next gun grab attempt. Now is the time to get all you can get.

I am not an expert about guns and didn't own one until I was in my early 30's long before I became a Deputy Sheriff. As for a crash course in self defense, the best defense is to practice, practice, practice with the weapons you have. I have put 30,000 rounds through my S&W .357 and still practice. I have put 10,000 rounds through my .22 rifle just for fun since the ammo is cheap and easily available. I recommend a supply of 10,000 rounds be kept for when the crunch comes.

Practicing with a hunting rifle like a 30-06 is expensive so reloading is the only option. I recommend as much ammo for it as you can afford since this is going to put food on the table for a time, as well as for a "reach out and touch someone" defense at long range. Premium bullets run about $1 a round or a little more.

In America joining the NRA or Gun Owners of America is critical if we want to keep our guns. I am a life member of NRA, and a member of GOA. Both have web sites. The NRA has 39,000 gun safety teachers and can be reached at

1-800-672-3888; http://www.nra.org/

Gun Owners of America:

8001 Forbes Place, Suite 102

Springfield VA 22151

Phone: 703-321-8585

Fax: 703-321-8408

http://www.gunowners.org/

For an organization in Australia comparable to the NRA check:

Sporting Shooters Association of Australia Inc.

P.O. Box 906

St. Marys, NWS 1790

Phone: 02-9623-4900

Fax: 02-9623-5900

http://www.ssaa.org.au/

OWNING FIREARMS IN AUSTRALIA

Requirements for owning weapons are now severely restricted in Australia. The official gun recall for semi-automatics and pump action shotguns went into effect 30 September 1997. There are a few circumstances which allow citizens to own a weapon. The general law states you must belong to a gun club and have proof of actively practicing. In some states, you must attend at least twice each year, other states require monthly attendance and in still others, just being a member is enough. Another circumstance where having a weapon is permitted is if you own at least 100 acres and need the weapon for varmint control. A third option is if you hunt or target shoot on a farmer’s property who has at least 100 acres. The farmer must write a letter stating this is your purpose which is submitted with the application. Since laws vary from state to state, check the requirements for your area. This information does not cover everything there is to know about owning and operating a firearm, but it is a good place to start. Oftentimes when we are very new to a topic, it helps to understand the basics so we can at least ask intelligent questions. This primer and the links should be enough to get you started; however, the choice to keep firearms and ammunition is up to the individual.

Additional Links and Information

holly@standeyo.com

http://standeyo.com

Contents © 1996-2008 Holly Deyo. All rights reserved. |